Texas Foreclosure Surplus Funds: An Intro to Excess Proceeds Rules in Texas

Texas Foreclosure Surplus Funds: An Intro to Excess Proceeds Rules in Texas

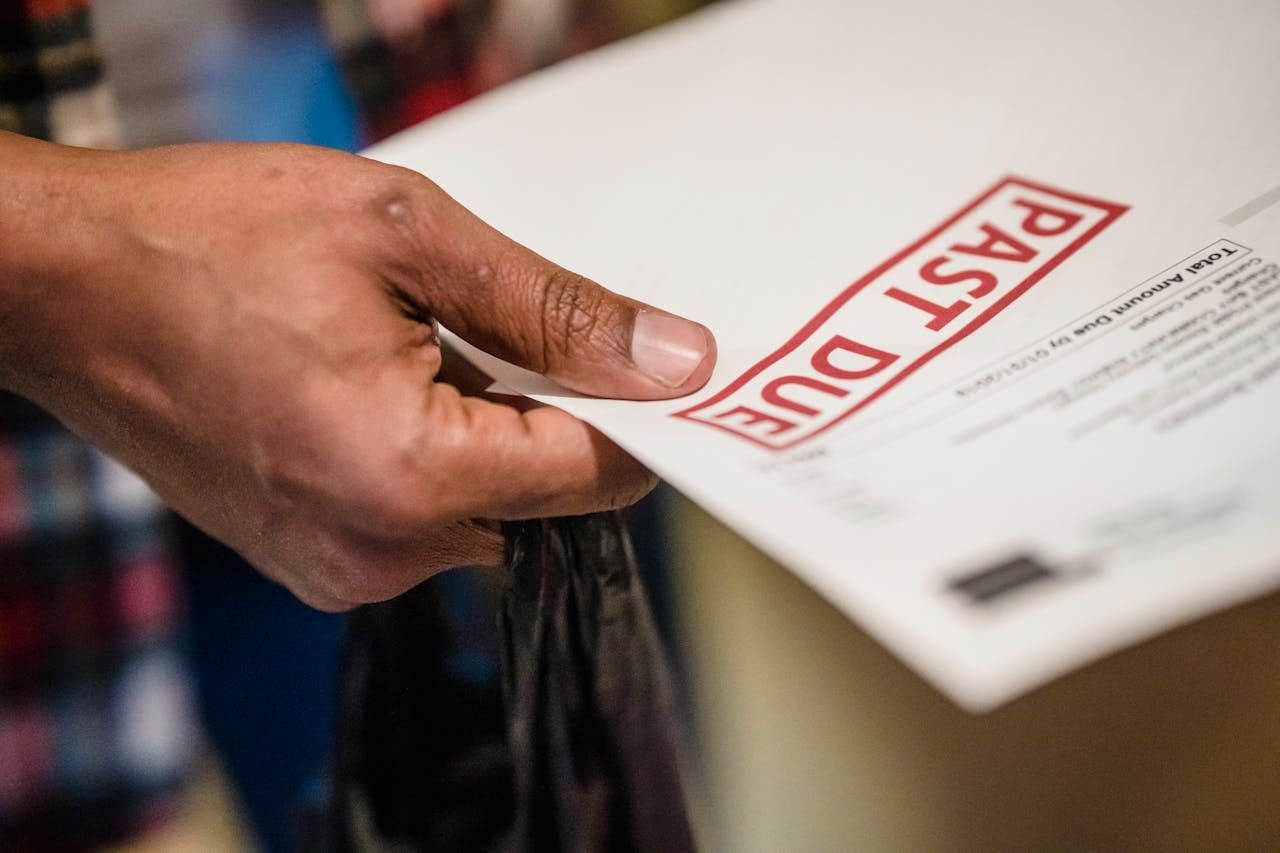

If you’re one of the thousands of Texas residents struggling after a tax-related foreclosure, there may be some good news for you.

A little-known law entitles you to the foreclosure surplus funds that the county generated after the sale of your home.

However, if you don’t act fairly quickly, you could end up missing out on tens of thousands of dollars that are rightfully yours.

Keep reading to learn more about this Texas law and how you can claim your tax sale overages.

What are Foreclosure Surplus Funds?

If, for whatever reason, you stop paying taxes on your home, the county will eventually step in and foreclose on your home. To recover the taxes they lost, they will then put your home up for auction.

Often, a home will sell for more than the amount needed to cover the unpaid taxes. In the state of Texas, the previous owner of the home is entitled to the extra money collected at the sale.

However, this money has to be claimed within two years of the sale of the home in a tax foreclosure context, and three years (generally) in the mortgage foreclosure context. Otherwise, at least in the tax context, the county may be able to keep the equity.

Since the county is only legally obligated to send out one notification of the availability of these funds, many of them go unclaimed. Often, this letter is sent to the foreclosed home address and the rightful owner never receives it.

How to Claim Excess Tax Funds

Let’s jump into the three necessary steps you need to take to claim these excess tax funds that are owed to you after the county has sold your foreclosed home.

1. Gather the Required Documents There are a number of documents that you’ll need to gather and submit along with your claim form. The required documents can vary as much as there are counties in Texas, depending, among other things, on the facts of the case or claim, your personal and familial history, and any concerns of the Trustee or Court. Engaging

an

experienced

lawyer is the best way to ensure you get everything you need.

Generally, here are some of the documents you could expect to gather in order to file any excess tax claim:

- A current copy of the deed

- A copy of the deed when you owned the home

- Any lien documents

- Marital history records (i.e., divorce, or annulment)

- A copy of valid, government-issued photo ID

Keep in mind that every single case is unique, and you will likely need additional documents to prove ownership (regardless of what may or may not appear in the public records). This is another reason we recommend hiring a lawyer who can ensure that everything is submitted properly the first time.

2. Complete any Trustee-Provided Claim Forms: Once you have all of your documents gathered, you can fill out the claim form. Most of the information you’ll need should be on the deeds. Once you complete the form, you will need to use a

notary public to sign it.

The seal and signature of the notary public will also have to be included with the rest of the documents.

3. Submit Your Claim Now all that’s left is to submit your claim along with all the required documents to the county. The Tax Officer will review everything and send you what they owe you as long as everything is in order.

Ready to Claim Your Money?

Now you know what foreclosure surplus funds are and how you can claim yours if they’re owed to you. Although there are a few steps to getting your money, you could get thousands of dollars or more, so it’s certainly worth the effort.

If you want to get as much money as possible for as little work as possible,

contact us today . We would be more than happy to investigate your case and determine if we are the right match to assist you to claim your excess proceeds.